As we all know, real estate can be very profitable but it doesn’t mean that the process is necessarily easy. Today’s guest also faced difficulties but he successfully pulled off his first house hack and now owns 3 properties.

Zac Collins is a software engineer who is also a real estate agent and investor. He stumbled upon the idea of real estate investing and thought to give it a try. Now, he has his cash flowing continuously from his properties and is living for free!

In today’s episode, learn more about house hacking as Zac talks about his journey to pursuing financial freedom. He also shared how he made his investments work for a long time. Lots of house hacking insights so listen until the end of it! Enjoy!

—

Listen to the podcast here

Getting Started On House Hacking With Zac Collins

Nick, how’s it going?

I’m doing great. How about you?

I’m doing pretty darn well. I got my fourth house hack underway. There’s a pretty big rehab going on there. I got my guy out from Jacksonville, who’s my good guy, to come out and do the rehab for me. He’s thinking about moving to Denver, which is pretty cool. I’m excited to see it when that thing is done.

You’re going to have your good GC out here working on all your projects.

That’s what I’m trying to do. Also, helping the client-side as well. Keeping everybody busy is the idea.

I have 5 or 6 clients I’m helping and trying to stay busy with that. Life is good.

We’ve got a pretty cool episode. He’s my buddy turned buddy, Zac Collins. He purchased his first property and is starting to ramp up and get to his next one. He has his ups and downs throughout this process. Real estate can be profitable, but it’s not necessarily super easy. He ran into a pretty big roadblock on his first property, but he got through it. His property is still cashflowing $1,000 or more a month and he’s living for free. That’s a good one.

You can’t beat that. When he explained his numbers to me, I was like, “That’s awesome.” That’s a killer first deal. He has a good story and it’s going to be a good show.

Let’s get right into it. Let’s get him on the show.

—

Welcome to the show, Zac. How are you doing?

Pretty good. How are you?

Doing good. Zac, we want to chat and hear a little bit about your story. I know you’ve got at least one house hack under your belt. You’re looking for your second one. How did you get started on this? How did you hear about financial independence? What made you want to get going and take action on it?

I am a software engineer with my W-2 job. I used to do a lot of learning surrounding software engineering. One of the thought leaders in that space is John Sonmez of Simple Programmer. I sent up an email chain at some point with him and he was talking about, “You have a higher income as a software engineer. How can you invest it?”

I stumbled upon the idea of borrowing money from banks and using that money to pay for a house that other people pay for and you can live for free. I thought that was a great deal. From there, I found BiggerPockets. The rest is history. John Sonmez does the Simple Programmer. He does a lot of different investing things for software engineering specifically and also how to do interviews and things when you’re first getting started in that particular field.

Is he in the financial independence realm too? Is he like, “This is a smart thing to do. I’m doing it. It’s a good idea.”

I won’t say he’s part of the FI community, but he’s well off and preaches starting your own business types of things.

At what point did you hear of this guy, John?

Probably when I was twenty years old, maybe in my sophomore year or junior college.

What year? Give us a frame of reference.

2015 maybe.

In 2015, you stumbled upon the idea of house hacking, which is younger than most. What action steps did you take after hearing his podcast or after hearing his stuff?

In the beginning, I found BiggerPockets after finding his stuff. I went through and listened to all of the BiggerPockets things up to that point. It was a lot of time that I spent getting that higher overview. From there, I jumped further into the details. A lot of the podcasts and BiggerPockets paint broad strokes. I did a little bit more investigation and the specifics of certain types of investing and how to buy the first deal, work it properly, so on and so forth. That was when I was in Michigan. I moved to Colorado. Over two years ago, I knew I didn’t want to live in Michigan for the rest of my life. It’s cold there in the winter and there’s not a whole lot to do where I grew up. After moving to Colorado, that was the time to pull the trigger on a house.

Your first three goals from 2015 to 2018. You educated and saved during that time. Being twenty years old, you had time on your side, so that’s what you should do at that age. Once you had enough saved for that down payment, you moved to Denver in 2018, and then what happened?

A good point to make too is that I did start saving at that point in time. I didn’t go out to eat. I didn’t do anything crazy. In my first job out of college, I wasn’t making a ton of money, but I was doing fairly well. I had enough to be able to set aside a good chunk of change for that first down payment. I then moved to Denver.

I met you, Craig, through a mutual friend, one of your previous tenants. I started looking for a house hack in the area and you helped me out with that. The deal itself, I wasn’t planning on buying the house hack. When I bought it, I hacked it a little bit quicker than I thought I would because I had the down payment in the bank and you helped me feel a bit more confident with the numbers and stuff in the area.

It’s a funny story. I was looking at a house with another guy who was a little bit more scared than Zac was to make the first move and a little bit too analytical rather than getting going. Zac was introduced to me by my former tenant, who I was fairly close with, but I only roomed with him for 2 or 3 months, but he’s a good dude. I was looking at houses with someone else and this guy was like, “This is a great deal.” He didn’t want it. I was like, “Zac, if you want it, take it.” Zac was like, “Screw it. If it’s good, I’ll take it.”

The first house hack that we looked at, we looked at it together first. The outside of the house doesn’t look good. I was seeing it from the curb and I was like, “This is not the one.” I looked around inside and it was like, “It’s a pretty good deal.” We started looking through how many rooms it had. It’s so much larger than it looks on the outside. It’s well optimized for a house hack. We’re looking at it and pricing it out and the numbers looked pretty fantastic.

I didn’t want to move at that point in time because it was late summer, early fall almost. I was trying to shoot for maybe early winter. You offered me to come along and do some more houses in the area. We looked at some houses and they were not as good as this particular deal with your other friend. I said, “How about we go take a look at the house that we already looked at because I had pretty good numbers.” Looking at it again, I was like, “That’s a good deal. I could probably work it. I could buy it now as opposed to later.”

Why don’t you run through the numbers, what that deal looks like, what it looked like, why it’s good, and what your strategy was with it?

It’s 5-3. It’s a flip. It’s an older house. 1944 was when it was built. It has a finished basement and a loft area. They finished the attic. The upper area is an apartment, so it has a room and its own bathroom. On the main floor, there are two bedrooms. In the basement, there are three bedrooms. That’s the house itself. Looking at it, there’s also a space for a washer and dryer. It has its own storage unit. It has a two-car garage. That’s the house itself.

The purchase price was $400,000. It appraised for $410,000 right when I was about to buy it. 5% down. It’s roughly $20,000 into the deal. I probably added about $5,000 worth of some paint, furniture, and locks. I’m able to collect around $4,000 in rent every month. With utilities, I charge a flat fee. It’s $50 per person for utilities.

In the summertime, it ends up giving me a little bit of money. In the wintertime, wearing the furnace a bit more, I pay into it a little bit above that $300 that I collect total. It’s also in a great area. It’s west of Denver. In that particular area, they’re building a mall. It’s a mile from my house. There’s a lot of gentrification in that particular neighborhood, which is great. I’m not counting on appreciation, but it also might be nice going into the future too.

Are all those long-term rent-by-the-room? Are you doing any Airbnb? What’s the strategy going into it?

Yeah. I prefer the rent-by-the-room strategy. With Airbnb, you could maybe make a little bit more money. For me, there’s a balance there. With rent-by-the-room, I don’t have to worry about it too much once I get to rent it out. It’s almost no maintenance for me, which is great. It’s where I’m with it anyways. I prefer the rent-by-the-room strategy.

Rent-by-the-room is great when you’re getting your first 1, 2, or 3 deals because the returns are much better. If you could find a property that can be rent-by-the-room and be converted to one of those single-families, you can make a kitchen downstairs and turn it into a duplex type thing. That way, when you start to scale, it becomes a little easier to rent the house out as its own unit versus the rent-by-the-room. Your house is like that. You’ve got the staircase that you can wall off and add a kitchen downstairs and you’ve got a little unit downstairs and a bigger unit upstairs.

You could make it into a duplex. It’s super easy. There are two entrances to the house. On the side house, there’s a wall that you could put there. There was a kitchen previously in the basement, too and the water hookups are already down there. That wouldn’t be too bad to add if I ever wanted to do that. My hope is to buy it in an area and with any luck, it’ll appreciate to a point where maybe I can make $400 or $500 for a single-family rental and go above. The mortgage maybe not be as good return but less work once you get up to 5 to 10 houses or somewhere in that range.

That’s a great strategy. You want to get every dollar out of that house as you can at first and then as your nest egg grows, you don’t need as high of a return to make the same passive income. With a little bit lower return, it means less work, which means more freedom for you.

I have a glutton for punishment, so I’ll probably keep that rent-by-the-room at least for maybe up to ten houses, but we’ll see.

Do whatever works best for you. $400,000. How much did you put down? How did you finance it? What’s your monthly payment? What’s all that good stuff?

5% down. $20,000 into the house with a conventional loan. At the time, I worked at a company where they match 50% up to the max 401(k) match. I did that with the intention of taking an early withdrawal for your primary residence from the 401(k). I put money in and they match it 50%. You get dinged with a fee for withdrawing from your 401(k) a little bit early. The way I looked at it, I had a 40% return on that particular money. I was able to do that. Also, I have pretty ample reserves too, if anything went wrong with the house at that point in time.

How much did you withdraw?

$13,000 from the 401(k). It’s 10%. It’s $1,300. The way I looked at it, I only put in $7,000 of that if that makes sense. You could do $1,300, but the company put another $5,000. It’s a pretty good deal at the end of the day.

You’re taking the free money your company gave you and using that as a buffer on your house investment. You said, “I’m going to get a higher return on this house hack,” which is 100% true than you would on living your 401(k) with 6% or 7%. You screwed your logical decision, which I love.

Generally, I was interested in real estate even at 18 or 19 before I heard about the house hacking stuff. The idea of a 401(k) is you take your money and you put in a 401(k) and save 20%. You hope the market gives you a certain return year over year. There’s no learning curve that you can put your own skills into to give you a return with any increase or decrease. You’re not responsible for that. That seems close to gambling and a little too close to hope for me as far as retiring. That was never something I wanted to do. Real estate provides that. The higher your skill level, the better returns you’ll make. You can ultimately systematize and make it into a business, which is great.

Let’s get back to those numbers. You got $20,000 down. As part of that, you took $13,000 out of your 401(k). 5% down. What was your monthly payment on that?

I started off at $2,200. It bumped up to $2,300. Something changed the escrow but $2,200, $2,300, or somewhere between there. The first year or two, I calculated it out. Ten months in, I’ve collected $43,000 in rent. I paid $22,500 for mortgage payments. There’s a $20,000 down payment. Something with the house is it’s an older home. Maybe three months after I moved in, I started noticing that some cracks were appearing in the plaster above certain windows at diagonal angles. I did a lot of research into that. It turns out that the house had some instructional issues. The person who fixed and flipped it painted over some of the cracks that were appearing.

I had a structural engineer look at the house before I purchased it and they said it was fine. I had two of them look at it and they both said it was fine. However, there are some issues there. I had a couple of second opinions. They’re saying the water from the driveway was backing into the house, which was causing some settling issues.

Get started with financial independence by listening to as many podcasts and reading as many books as you can. Share on XI also ended up having to do a grading job around the house. I semi pave the driveway with some road base and then add a retaining wall, which is about $15,000 worth of work to regrade around the entire house, the backyard, and the driveway. That was also a fairly large expense. At the end of the year, including the down payment, it was $57,000 in total expenses. I have collected about $43,000 in rent so far, plus living free. The way I look at it, it was a win the first ten months even.

Can we maybe talk about those numbers a little bit on a monthly basis? It’s a little bit easier to swallow. Your mortgage payments $2,200, $2,300 a month. What are you getting in rent?

It’s $4,000 or $4,300 with utilities.

Let’s say $4,000. Let’s assume the utilities wipe themselves out because you pay them and let’s say it’s washed. $4,000 on a $2,200 mortgage. Plus, you’re living for free. On top of that, you also have the load paid down, the appreciation. It sounds like you had that problem with the structural issue, which does suck. Have you ever thought about going after those structural engineers? If they have a stamp saying that they said that the structure was good, structures don’t go to crap in six months.

They did stamp that there. That is a possibility. I talked to a couple of lawyers about it. Another thing too is the seller who sold it, the flip and they did me dirty there as far as not disclosing that issue because that issue was there. You could do a few different things. There are a lot of lawyers that I talked to. It could be two years, $50,000 to $100,000 lawsuits. A lot of times, it’s not worth it. I’d rather put the $15,000 and count it as a business expense and move on.

You did your research there and you knew about that. That’s unfortunate. That’s the reality of real estate. That’s what you sign up for. You’re getting $1,700 or maybe $1,000 or more in rental income and cashflow from that property. Things are going to come up. It’s not always that big of an expense, a structural expense. You know now, at least for the future, this thing is going to be good and it’s going to be a solid cashflowing property for you. That’s in a great area that’s going to make you quite wealthy over time. That area continues to appreciate.

With real estate, I won’t make that mistake again. All the properties or something, I’ll probably shy away from in the future. I learned a lot more about the construction and what to look for in a house as far as the structural and the construction aspects of it after doing a ton of research trying to figure out that problem.

After doing the grading job, they had a few different options on how to solve that. One of them was the grading job. One of them was to put helical piers around the house, which had been about $30,000. The grading solves it, though. I haven’t noticed any more movement or any of the cracks getting any larger at all. It also makes the outside of the house look a little bit nicer as well. If I ever do want to get a HELOC or refinance it at some point in time, that might also contribute a little bit, at least to the value of the house.

Can you explain to everybody what HELOC is?

It’s a line of credit from a bank. If you have a mortgage for $380,000 and your house is worth $420,000, they’ll potentially give you the extra $40,000 gap in between those two numbers that you can use to do other things with.

Like the equity in your house, the banks will lend on that because that’s part of your net worth and that’s money you have. The banks won’t usually lend the entire difference, but they’ll lend a portion of it. It’s a great way to start doing other deals afterward.

I probably won’t. I’ll probably leave it in there just in case. It’s good to have that there and keep the monthly mortgage payments low. It’s always an option. It gives you a little flexibility.

That leads us to where we are right now. What’s next for you? What are your next steps? What do you want to do?

Software engineering is pretty lucrative. That’s something that I have been spending a lot of time on the last few years. I switched jobs a couple of times and increased my income a lot there as well as the house and reduced my expenses completely. I should be able to get another house hack at the end of September 2020, which is the anniversary of the first one. I’ll probably buy a 20% rental property in the same area.

I’m probably going to stay in that Westminster area. West of Denver was pretty good as far as reasonably priced homes. I may go into Denver, too, depending on what I can find. Ideally, I’d find something that I could add a little appreciation to, add a little value to, maybe an unfinished basement and be able to finish that. Pretty much moving forward, acquiring more properties up to maybe ten. I’ll then probably switch to single-family rentals and do similar things.

You’re well on your way. You picked your first one up when you were 24. You’re going to get the next at 25. By the time you’re 26 or 27, you should have 3 or 4 of these things down and have $3,000 to $4,000 in passive income. I’m sure that’s all you need to hit based on financial independence and then you can grow from there and start introducing a little bit more luxuries into your life.

At the end of the third one, I should be able to net $3,000 or $4,000 and be financially independent if I ever wanted to or if I wanted to move away from software, for example. I also completed my real estate license course. I’ll be taking an exam. I’ll be getting that to represent myself on the next house, which is nice because you get a rebate on every house that you buy as well as being able to see the market faster and make offers faster. Ultimately, I’d like to start my own brokerage in the five-year mark.

You started here on real estate. We might have to chat about starting your own brokerage. That’s a great plan. If you are going to house hack, you’re going to do it methodically year after year. Getting your license is a good thing to do. I would recommend not doing it for your first one, just so you know the ropes and be led through it. After the second one, you can use the contract in your first one as a guide to writing your first contract and stuff. You figure it out as you go.

The idea here is that your license will probably cost you about $2,000 in your first year with startup costs including the school and another $1,000 to maintain it year after year. In Denver, when you close one deal, it’s going to be about $10,000. It’s worth one deal a year. If you’re going to do one deal a year, it’s worth it to have your license. Congratulations on doing that. Keep me posted on the results of that test.

You can take it as many times as you need to. If I failed the first time, I figured I’d take it a couple more times if I needed to. I should be able to get it.

I’m sure you’ll get it. I took mine and I was nervous because a lot of the questions weren’t questions that I was prepped for. You’ll get it. You should have no issues with it. How was the class that you took?

I took Real Estate Express, the online course. Honestly, it was awful. It was terrible. It gives me the thing to be able to take the exam. I’ve gotten a few different study courses and smaller flashcards that helped explain some things a little better than that particular course does. There’s ample material outside of that course to study for the exam. The course leaves some fundamentals for you.

Classes are boring as all hell.

Especially the online ones. Did you take one online, Nick?

It was online. It was the Colorado School of Real Estate. It was a drag.

I did one too. Not only is the material super dry, but they picked the most boring guy to do it.

I remember a few of the exams on Real Estate Express. The question was wrong and there are typos in the answers. There’s one that’s triple-negative. I’m like, “Why is a question phrased like this?” You get through it.

You paid for it, right?

It was $300.

That sounds good. We’re about ready to hit The Final Four. The first question we typically ask is, is there a book that you’re reading right now? If so, what is it?

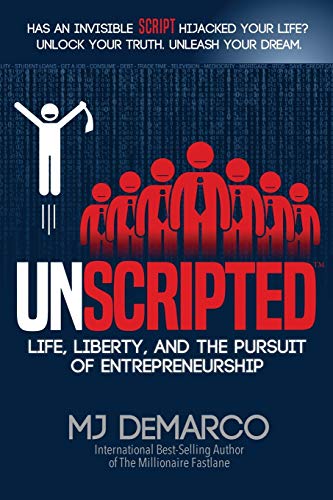

I’m reading UNSCRIPTED by MJ DeMarco. That’s a pretty good book. It talks about achieving financial independence. It sums up a lot of the different thoughts that I’ve had as far as financial independence goes. That’s a recommended one.

The second question is, what is the best piece of advice you’ve ever received?

Probably to house hack, in general. As far as financial independence, that’s always a great way to get started. Listen to podcasts and read as many books as you can. That’s one that is repeated over and over again, but it’s true.

Your third question, what is your why?

My parents never saved too much when they were working and stuff. I’d like to be able to create a system that will support them and be able to retire in the next few years. That’s my purpose for doing this.

I know a lot of people who want the free time and to be able to travel and hang out with their family and stuff. I don’t think I’ve heard that yet.

For me, I love working. I probably will never stop working. It will provide a little bit of a safety net there to be able to start my own brokerage or take some other leaps of faith as far as being like a real estate agent, for example, and still having that steady backup income. I probably will never retire. I might as well let them while they’re getting older.

Who would you be and why if you could be a fictional character?

Maybe one of the X-Men who can fly because flying seems like a lot of fun to me.

I’ve never seen that movie or show or whatever it is.

I haven’t watched the movies, but I read some of the comic books growing up when I was a little.

Where can people find out more about you?

I changed my Instagram handle to @BuyTimeFirst. You can follow me on Instagram. I bought the domain name as well, BuyTimeFirst.com. As opposed to buying things, buy your freedom.

Zac, thanks for coming to the show. Thanks for sharing your story. You’re almost at an inflection point here where you’re about to get your second one and your third might be soon after and that’s when you start feeling the fruits of your labor. The first year is a drag. Once you get beyond that, you start feeling it.

Thanks for having me. I appreciate it.

Good talking to you.

—

That was Zac Collins. What did you think, Nick?

He was awesome. He’s a cool, laid-back guy. He has a great job. He’s got a great plan for his future and the whole house hacking. He’s got it down. The fact that he wants to start his own brokerage and represent himself in the future, it’s smart for him to do that.

He’s analytical and systematic. He’s going to run the numbers and make sure that it makes sense for him and those around him. He’s good at making quick decisions based on the numbers and not overanalyzing, which is a downside for a lot of people and not getting caught up with the emotions of the deal. He talked about how he had to spend $15,000 or $20,000 on that structural issue. It sucks, but he’s chalking it up, “That’s a lesson learned. I now learned a lot more. I’m going to be able to apply that knowledge for the next one.”

That’s what it’s all about. You learn as you go and you grow. That’s awesome.

I’m going to let you get back to your wife and your kids. I will see you.

Talk to you soon.

Important Links